Accelerating and Aligning Population-Based Payment Models:

Financial Benchmarking

Report: Released June 30, 2016

Description

Related Papers

The PBP Work Group authored four papers focusing on issues foundational to the success of PBP models. These include:

Authors

Publication Info

Publication date: June 30, 2016

21 pages

Suggested Citation: Health Care Payment Learning & Action Network. Accelerating and Aligning Population-Based Payment: Financial Benchmarking. June 30, 2016.

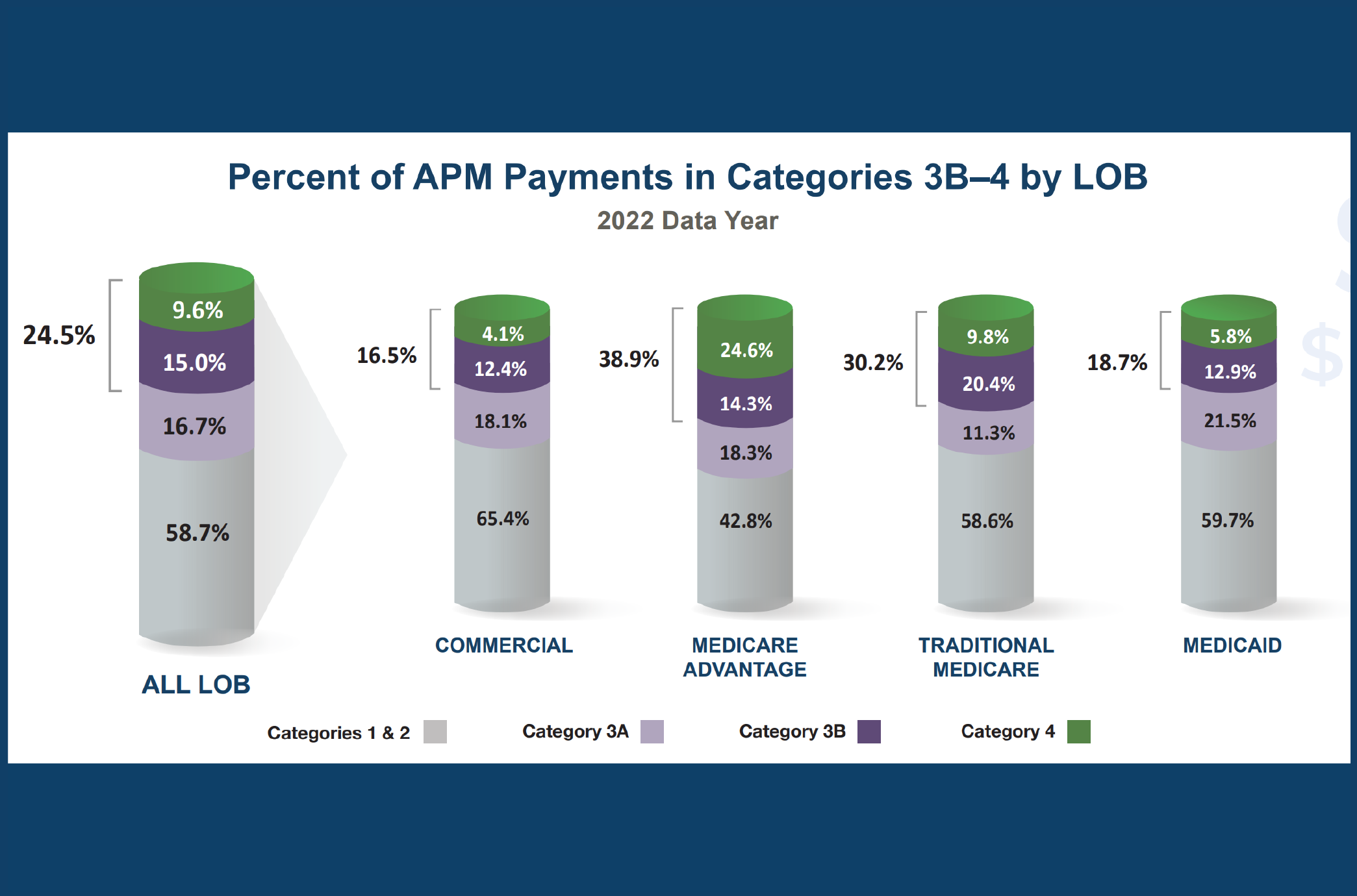

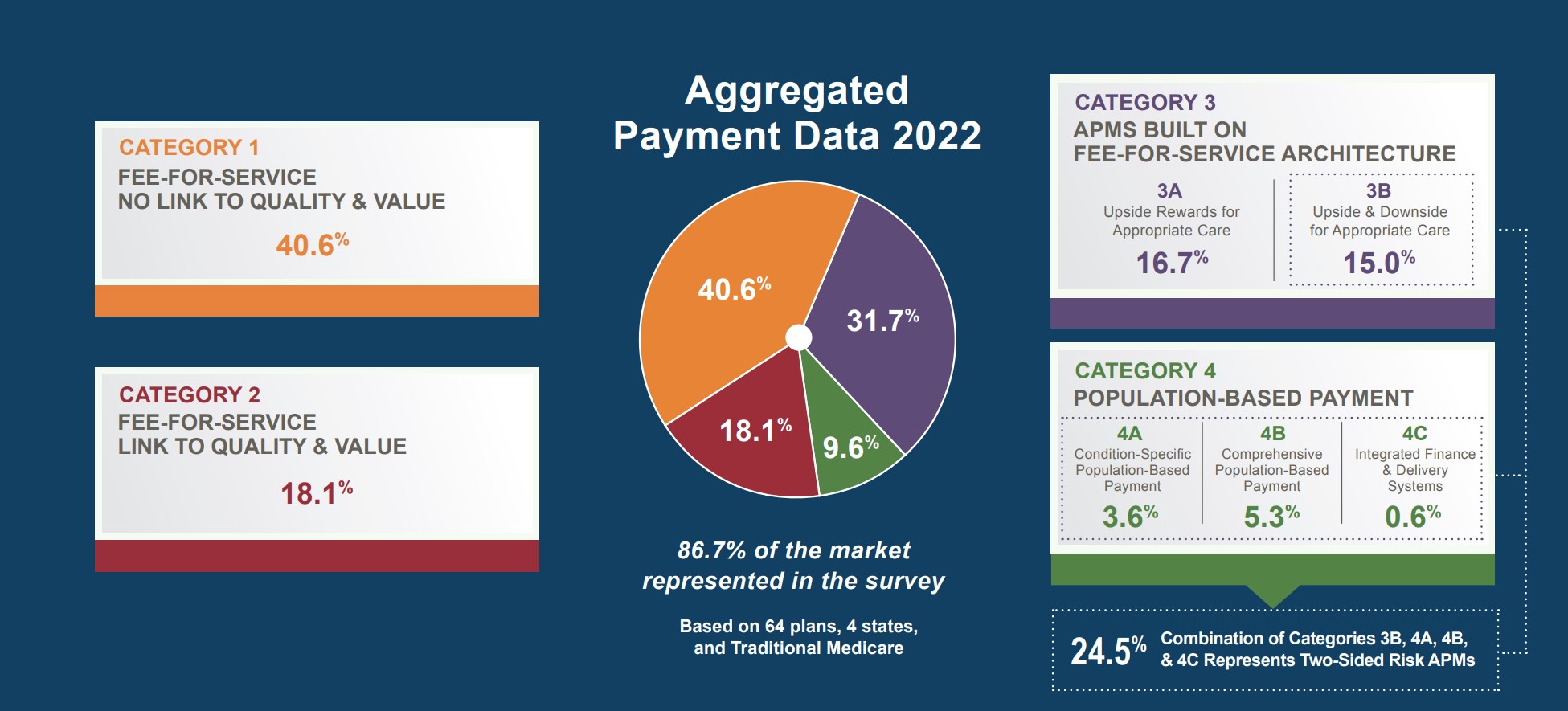

Alternative Payment Models (APMs)

Alternative payment models deviate from traditional fee-for-service (FFS) payment, insofar as they adjust FFS payments to account for performance on cost and quality metrics, or insofar as they use population-based payments that are linked to quality performance.

Fee for Service (FFS)

The existing FFS system creates incentives for additional volume of services, while also undervaluing certain services. The current FFS system is not conducive to the delivery of person-centered care because it does not systematically reward high-quality, cost-effective care.

Financial Benchmark

A financial benchmark is a population-based spending level that is used to establish PBP rates for providers. Financial benchmarks may be based on a provider organization’s spending in the previous year (i.e., “historical” benchmarks), on regional or national spending levels (i.e., “regional” and “national” benchmarks), or through some mechanism (e.g., bidding). Once a method for setting benchmarks is in place, updated benchmarks must be risk-adjusted to take into account patient mix. Additionally, financial benchmarks should be adjusted to account for geographic variation in input costs (e.g., wages, rents, etc.) if variations exist across the covered region, but they should not be adjusted on account of variation in utilization of medical care.

Full Continuum of Care

All aspects of care delivery, spanning preventive to end-of-life services in all settings.

Population-Based Payment (PBP)

Population-based payment models offer providers the incentives and flexibility to strategically invest delivery system resources, treat patients holistically, and coordinate care.

Population-Based Payment Model

A payment model in which a provider organization is given a population-based global budget or payment and accepts accountability for managing the total cost of care, quality, and outcomes for a defined patient population across the full continuum of care. PBP models discussed in this paper correspond to payment models in Categories 3 and 4 of the LAN’s APM Framework.

Total Cost of Care (TCOC)

A broad indicator of spending for a given population (i.e., payments from payer to provider organizations). In the context of PBP models, in which provider accountability spans the full continuum of care, TCOC includes all spending associated with caring for a defined population, including provider and facility fees, inpatient and ambulatory care, pharmacy, behavioral health, laboratory, imaging, and other ancillary services.

The LAN has written a suite of papers to help align payment reform efforts.

The papers include recommendations on the design of two payment reforms—population-based payments and clinical episode payments—from the two most comprehensive categories defined in that framework. These recommendations are the result of input from a wide variety of persons and organizations with either direct experience with implementing one or the other payment reform or deep experience in the health care field.

What is the purpose of the Population-Based Payment (PBP) Work Group’s White Paper, Accelerating and Aligning Population-Based Payment Models: Financial Benchmarking?

The purpose of the White Paper is to provide a blueprint that can help guide the technical work of establishing, updating, and rebasing financial benchmarks in population-based payment models. Like any blueprint, the White Paper offers an overview of technical issues that must be addressed when making decisions about financial benchmarking, with an eye toward providing practical guidance. But, like any blueprint, the White Paper does not seek to resolve fully each and every technical issue; for example, where the evidence is sparse and consensus not forthcoming, the PBP Work Group allows for the discretion of local health care decision makers.

In addition to offering technical considerations, the PBP Work Group deliberated at length about how to properly balance the imperative to quickly achieve deeply needed efficiencies with the need to recognize significant financial and operational obstacles. The Work Group ultimately decided to favor the former over the latter, such that its recommendations reflect aspirational goals for payment reform.

Why is financial benchmarking critical to the success of population-based payment models ?

All population-based payment models should employ financial benchmarks to establish spending levels, typically on a per-member-per-month basis. Both payers and providers use these benchmarks to manage resources, plan investments in delivery support infrastructure, and identify inefficiencies. Financial benchmarks are established through notice-and-comment rulemaking in the public sector, but in the private sector, they are negotiated between payers and providers.

Establishing financial benchmarks is critically important and technically challenging because it involves a broad assortment of complicated considerations that often require difficult tradeoffs among competing priorities. Therefore, the PBP Work Group expects that local circumstances will necessitate different weightings of priorities, resulting in legitimate variations in the technical details that underwrite financial benchmarking approaches.

Because the economic modeling needed to predict the financial implications of different approaches is only just beginning to appear, the PBP Work Group does not believe a “one size fits all” approach is viable, and the purpose of the White Paper is not to advance one. Nevertheless, because certain types of variation can impede progress in the goals of reforming health care spending and improving health care delivery by establishing counterproductive incentives for provider organizations, the Work Group has endeavored to identify the technical elements of financial benchmarking that carry significant consequences for health care spending.

Given the wide variability of cost at the national level, why should the basis of benchmarking trend toward national, as opposed to regional data?

The PBP Work Group did not reach consensus on whether adjusted payments should be pegged to national benchmarks to ensure uniformity across the country. Nevertheless, there was a strong consensus that regional benchmarks should represent the immediate end point for convergence, and that this is an achievable goal.

How can financial benchmarks be set to incentivize all organizations, even those that are not efficient? And in contrast, how can advanced organizations, those that already have low costs, be appropriately rewarded?

The initial financial benchmark should be established in a way that favors lower efficiency organizations, but higher efficiency organizations should experience more favorable conditions each time the benchmark is updated or rebased. This approach is intended to ensure that high performers have the resources they need to succeed and that low performers adapt to higher and higher expectations.

Further, the recommended approach to financial benchmarking moves through three stages as the population-based payment model matures:

- In the first stage, financial benchmarks are set to maximize participation among provider organizations, and inefficient organizations in particular, in order to achieve limited efficiencies in the short run. The purpose here is to attract a critical mass of providers and secure long-term commitments to population-based payment models.

- In the second stage, adjusted payments to comparable provider organizations are brought into alignment, incrementally driving efficiencies as provider organizations acclimate to new payment arrangements, invest in delivery system improvements, eliminate cost and quality issues, and build trust with payers that administer population-based payment models. The goal of the second stage is to allow provider organizations the time and flexibility to reorient practices, resources, and workflows to align with population-based payment.

- In the final stage, the financial benchmarks for all provider organizations in a common market converge, such that risk- and input-price-adjusted payments to all participants in the population-based payment model are equivalent.

Once convergence occurs, the PBP Work Group envisions a steady state for the payment model in which periodic updating (or rebasing) of the benchmark will impact all participating provider organizations identically.

How and when will financial benchmarks for the many different kinds of participating organizations reach convergence?

Financial benchmarks should be used to drive convergence in adjusted payments from public and private plans within a common payer segment (e.g., between Medicare, Medicaid, and private payers). It is essential to achieve convergence as quickly as possible due to the anticompetitive incentives in historic benchmarks; however, the speed of convergence is constrained by a variety of factors:

First, the voluntary nature of participation limits the ability to lower payments to inefficient organizations. Although financial benchmarks are only one element in the incentive structures that underwrite a population-based payment model, they are a critically important consideration when provider organizations decide whether to participate or remain in an alternative payment model. If convergence moves too fast, inefficient provider organizations will likely drop out, thereby minimizing the overall impact of the population-based payment model on payment reform.

Second, private payers must negotiate contracts with provider organizations, and leverage in these negotiations is dictated by local market powers. A lack of leverage in contracting can limit the rate at which private payers can drive convergence. Public payers and private payers with more market power have more latitude to expedite convergence, but even in these cases the speed of convergence will be diminished by the voluntary nature of participation.

Finally, the speed of convergence will be constrained by extensive disparities in payment that exist in many regions today. Because the payment gaps between efficient and inefficient provider organizations can be quite wide, it will take more time to close them, even if current rates for inefficient providers are held constant.

How do the LAN's financial benchmarking recommendations address rolling performance periods based on annual benefit changes?

Prospective attribution looks back at past claims (over a defined period of time) to identify patient use of services and then prospectively attributes the patient to a provider group and/or delivery system before the measurement period begins. This attributed list of patients then remains fixed throughout the measurement period (typically, 12 months). Using this prospective model, provider groups know the patients for whom they are accountable at the beginning of the measurement period.

In addition, this locked-in list can help providers prioritize patients for outreach and preventative health care. Note that changes in patients’ use of care during the measurement period do not change the patient cohort or attribution list; providers are accountable for their original patient list, regardless of whether patients’ care patterns over the year suggest they have changed systems. In contrast, the provider cannot gain formal accountability for new patients during the year, even if those patients’ care patterns identify the provider to be their primary source of care.

Do specific risk-adjustment methodologies exist for those providers who care for the most complex patients, for example those receiving care in long term care facilities?

Transparency is paramount to enabling patients to be proactively engaged in their own health care. And information on attribution can be provided to patients in many ways. Providers, payers, or purchasers, all of who have access to this information, can facilitate a process to enable information sharing on patient attribution. Determining who provides the information and how it is explained to patients are essential to ensuring that patients understand the goals of population-based payment models. The choice of which organization informs patients of their attribution should be carefully weighed.

The PBP Work Group welcomes the submission of case studies describing the successful use of accurate and timely data for patient attribution. Please submit case studies by emailing PaymentNetwork@mitre.org.

Why was the PBP Work Group created?

Currently, there is much interest in population-based payment models because they offer a promising approach to efficiently create and sustain delivery systems that advance value, quality, cost effectiveness, and patient engagement. Both public and private stakeholders are exploring how best to promote acceleration and alignment of these payment models.

In November 2015, the Guiding Committee (GC) of the Health Care Payment Learning & Action Network (LAN) convened the PBP Work Group to support the development, adoption, and success of payment models under which providers accept accountability for a patient population across the full continuum of care. Such models vary in the mechanism by which payment passes from payers to providers, ranging from those employing a global population-based budget, while retaining the underlying fee-for-service (FFS) payment architecture, to those in which an actual population-based payment is made from payer to provider.

The GC was interested in models that fall within Categories 3 and 4 of its Alternative Payment Model Framework. Components of population-based payment models include developing policies that encourage a shift away from FFS payments to enable more substantial reforms in care delivery. They also address the following four priority issues:

- Attributing patients to a provider group

- Setting and updating financial benchmarks

- Sharing data between payers and providers and between providers and other providers in the market

- Measuring performance

A roster of PBP Work Group members, representing the diverse constituencies brought together by the LAN, is available on the LAN website.

How can we get our organization involved in a population-based payment model?

There are several ways to get involved. CMS provides a wealth of information on shared savings programs and accountable care organizations. In addition, the non-profit Health Care Incentives Improvement Institute, a member of the LAN, provides information on savings implementations. In addition, the PBP Work Group welcomes submissions of case studies discussing how organizations became involved with population-based payment models. Please submit case studies by emailing PaymentNetwork@mitre.org.

How can small providers partner with hospital systems to adopt population-based payment models?

The PBP Work Group welcomes submissions of case studies discussing how small providers partnered with hospitals or other delivery systems to adopt population-based payment models. Please submit case studies by emailing PaymentNetwork@mitre.org.

Webinars

November 2015 Webinar: LAN Learnings: Population-Based Payments (archive)

February 2016 Webinar: LAN Update: Accelerating and Aligning Population-Based Payment Models: Preliminary Recommendations on Patient Attribution and Financial Benchmarking (archive)

February 2016 Webinar: States Listening Session: Patient Attribution & Financial Benchmarking for Population-Based Payment Models (archive)

March 2016 Webinar: LAN Listening Session for Providers: Preliminary Recommendations on Patient Attribution and Financial Benchmarking (archive)

April 2016 Webinar: LAN Summit Session: When APMs Intersect: The Challenges and Opportunities of Implementing Episode Payment in a Population-Based Payment Environment (archive)

Blogs

Population-Based Payment Models: Overcoming Barriers, Accelerating Adoption

by Dana Gelb Safran, ScD; Glenn Steele, Jr, MD, PhD; and Elizabeth Mitchell

Archival Materials

Draft Paper: Accelerating and Aligning Population-Based Payment Models: Financial Benchmarking

Summary of Public Comments: Summary of Public Comments

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models.

Emily DuHamel Brower, M.B.A., is senior vice president of clinical integration and physician services for Trinity Health. Emphasizing clinical integration and payment model transformation, Ms. Brower provides strategic direction related to the evolving accountable healthcare environment with strong results. Her team is currently accountable for $10.4B of medical expense for 1.6M lives in Medicare Accountable Care Organizations (ACOs), Medicare Advantage, and Medicaid and Commercial Alternative Payment Models. Mr. James Sinkoff is the Deputy Executive Officer and Chief Financial Officer for Sun River Health (formerly known as Hudson River HealthCare), and the Chief Executive Officer of Solutions 4 Community Health (S4CH); an MSO serving FQHCs and private physician practices.

Mr. James Sinkoff is the Deputy Executive Officer and Chief Financial Officer for Sun River Health (formerly known as Hudson River HealthCare), and the Chief Executive Officer of Solutions 4 Community Health (S4CH); an MSO serving FQHCs and private physician practices. Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System.

Victor is the Chief Medical Officer for TennCare, Tennessee’s Medicaid Agency. At TennCare, Victor leads the medical office to ensure quality and effective delivery of medical, pharmacy, and dental services to its members. He also leads TennCare’s opioid epidemic strategy, social determinants of health, and practice transformation initiatives across the agency. Prior to joining TennCare, Victor worked at Evolent Health supporting value-based population health care delivery. In 2013, Victor served as a White House Fellow to the Secretary of Health and Human Services. Victor completed his Internal Medicine Residency at Emory University still practices clinically as an internist in the Veteran’s Affairs Health System. Dr. Brandon G. Wilson, DrPH, MHA (he, him, his) joined Community Catalyst as the Director of the Center for Consumer Engagement in Health Innovation, where he leads the Center in bringing the community’s experience to the forefront of health systems transformation and health reform efforts, in order to deliver better care, better value and better health for every community, particularly vulnerable and historically underserved populations. The Center works directly with community advocates around the country to increase the skills and power they have to establish an effective voice at all levels of the health care system. The Center collaborates with innovative health plans, hospitals and providers to incorporate communities and their lived experience into the design of systems of care. The Center also works with state and federal policymakers to spur change that makes the health system more responsive to communities. And it provides consulting services to health plans, provider groups and other health care organizations to help them create meaningful structures for engagement with their communities.

Dr. Brandon G. Wilson, DrPH, MHA (he, him, his) joined Community Catalyst as the Director of the Center for Consumer Engagement in Health Innovation, where he leads the Center in bringing the community’s experience to the forefront of health systems transformation and health reform efforts, in order to deliver better care, better value and better health for every community, particularly vulnerable and historically underserved populations. The Center works directly with community advocates around the country to increase the skills and power they have to establish an effective voice at all levels of the health care system. The Center collaborates with innovative health plans, hospitals and providers to incorporate communities and their lived experience into the design of systems of care. The Center also works with state and federal policymakers to spur change that makes the health system more responsive to communities. And it provides consulting services to health plans, provider groups and other health care organizations to help them create meaningful structures for engagement with their communities. Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Tamara Ward is the SVP of Insurance Business Operations at Oscar Health, where she leads the National Network Contracting Strategy and Market Expansion & Readiness. Prior to Oscar she served as VP of Managed Care & Network Operations at TriHealth in Southwest Ohio. With over 15 years of progressive health care experience, she has been instrumental driving collaborative payer provider strategies, improving insurance operations, and building high value networks through her various roles with UHC and other large provider health systems. Her breadth and depth of experience and interest-based approach has allowed her to have success solving some of the most complex issues our industry faces today. Tam is passionate about driving change for marginalized communities, developing Oscar’s Culturally Competent Care Program- reducing healthcare disparities and improving access for the underserved population. Tamara holds a B.A. from the University of Cincinnati’s and M.B.A from Miami University.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.

Dr. Peter Walsh joined the Colorado Department of Health Care Policy and Financing as the Chief Medical Officer on December 1, 2020. Prior to joining HCPF, Dr. Walsh served as a Hospital Field Representative/Surveyor at the Joint Commission, headquartered in Oakbrook Terrace, Illinois.